Working Papers

“Insurance Design and the Passthrough of Nominal Drug Prices”(with Josh Feng)

When plans must provide a minimum level of coverage, sponsors have an incentive to use list prices and rebates to circumvent coverage restrictions and increase patient cost-sharing. Using exposure to the Medicaid market as an instrument, we confirm that higher list prices lead to higher patient out-of-pocket costs. Passthrough is lowest in PPO and HMO commercial plans and highest in HDHPs and Medicare Part D plans.

“Stocking Under the Influence: Spillovers from Commercial Drug Coverage to Medicare Utilization”(with Emma B. Dean and Josh Feng) Revisions requested at American Economic Review

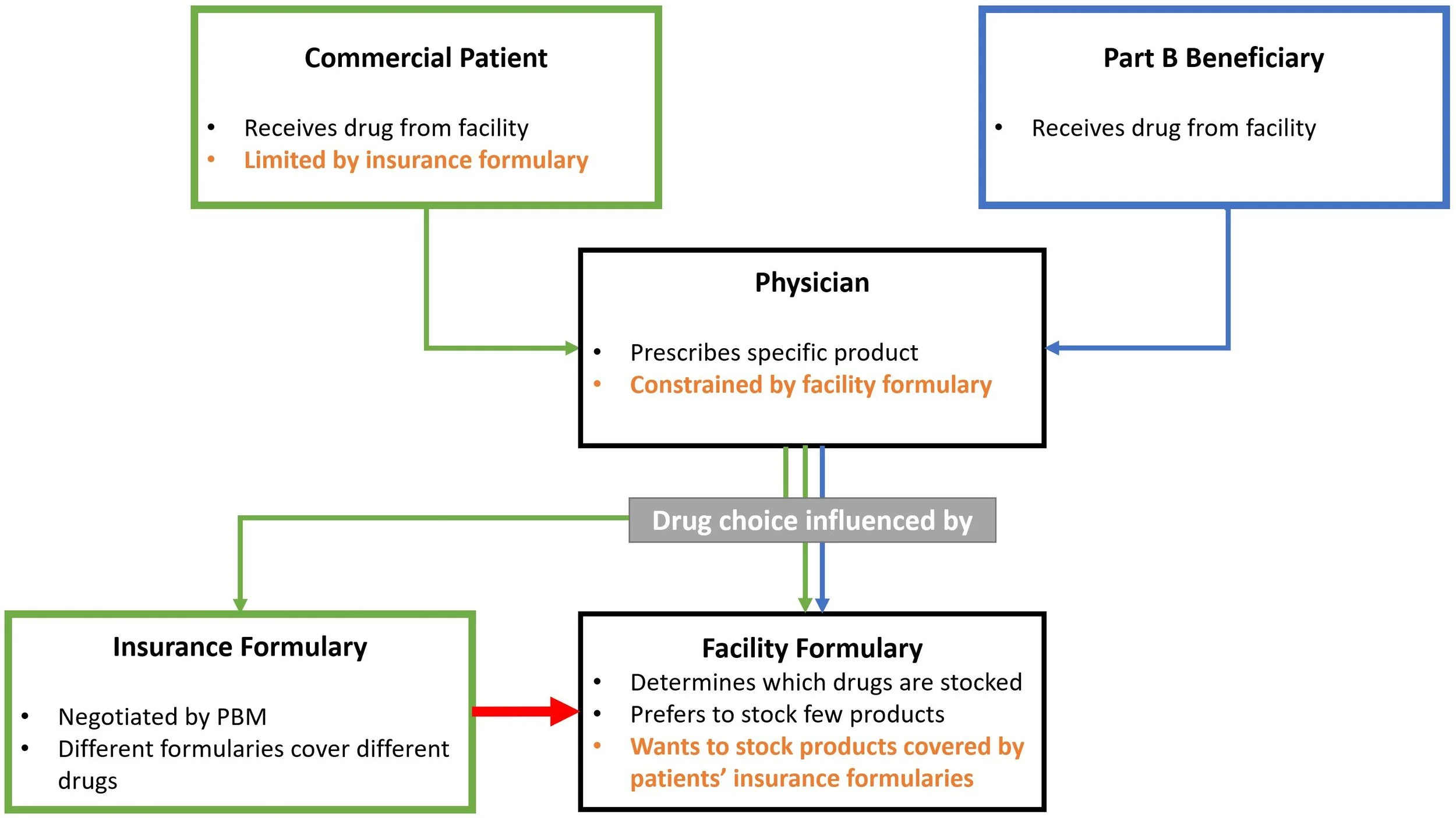

We argue that drug coverage in commercial insurance can affect utilization in Medicare Part B. Leveraging state-level variation in the adoption of national formularies as an IV, we show that higher exclusion rates in commercial formularies are causally linked to lower Part B utilization. Prescribing patterns of physicians operating across multiple facilities show that the effect is not driven by physician preferences but by facility stocking behavior.

“Biosimilar Entry and the Pricing of Biologic Drugs”(with Josh Feng, Thomas Hwang, and Jacob Klimek) Revisions requested at Review of Industrial Organization

We show that originator biologics respond to biosimilar entry by reducing net-of-rebate prices to maintain volume, in contrast to the well-documented response of small-molecule drugs to generic entry, and provide suggestive evidence that perceived differences drive the strategic response.

Publications in Economics

Feng, Josh, Thomas Hwang, Yunjuan Liu, and Luca Maini. “Mergers that Matter: The Impact of M&A Activity in Prescription Drug Markets” accepted, Journal of Political Economy Microeconomics.

We build a novel dataset tracking acquisitions of branded drugs. Horizontal acquisitions that escape regulatory scrutiny are followed by large price increases. Cross-market acquisitions that do not involve directly competing drugs do not have a detectable effect on prices.

Media coverage: Chicago Booth Review

Associated documents: public comment on proposed changes to the premerger notification program

Feng, Josh, and Luca Maini. “Demand Inertia and the Hidden Impact of Pharmacy Benefit Managers” Management Science 70, no. 12 (2024): 8940-8961.

Slides

We estimate a dynamic structural model of drug pricing using net-of-rebate prices of anti-cholesterol drugs from 1996-2013 and use it to argue that inertia in drug demand obscures the impact of PBMs on prices and spending.

Feng, Josh, Thomas Hwang, and Luca Maini. “Profiting from Most-Favored Customer Procurement Rules: Evidence from Medicaid” American Economic Journal: Economic Policy 2023, 15(2): 166–197)

Online Appendix, Slides

We find that an increase to Medicaid’s minimum drug rebate under the Affordable Care Act in 2010 lowered non-Medicaid drug spending by 2.5 percent. The result is likely driven by the interaction of this reform with Medicaid’s “most-favored customer” clause (MFCC).

Maini, Luca, and Fabio Pammolli. “Reference Pricing as a Deterrent to Entry: Evidence from the European Pharmaceutical Market” American Economic Journal: Microeconomics, 2023, 15(2): 345–383

Online Appendix, Slides

We estimate a structural model to show that drug manufacturers delay the launch of novel drugs in low-income European countries by up to one year in response to incentives generated by External Reference Pricing policies

Media coverage: StatNews, RealClearPolicy, The Economist

Publications in Health Policy

Axelsen, Kirsten, Delphine Courmier, Ge Bai, and Luca Maini. "Savings from biosimilars and Medicare formulary access." Health Affairs Scholar 3, no. 11 (2025): qxaf214.

Kakani, Pragya, Bradley Katcher, and Luca Maini “Improved Insurance Coverage Increased Biosimilar Semglee’s Market Share After The FDA’s Interchangeability Designation.” Health Affairs 44, no. 11 (2025): 1417-1425

Benjamin N. Rome, Katherine Garrett, and Luca Maini. "Medicare Part D Savings Under the Manufacturer Discount Program vs Coverage Gap Discounts" JAMA Network Open, 8, no. 9 (2025): e2530778.

Hwang, Thomas J., and Luca Maini. "Challenges in Delivering Most-Favored-Nation Pricing for Prescription Drugs in the US." JAMA 334, no. 9 (2025): 763–764.

Kakani, Pragya, Michael Anne Kyle, Amitabh Chandra, and Luca Maini. "Medicare Part D Protected-Class Policy Is Associated With Lower Drug Rebates." Health Affairs, 43, no. 10 (2024): 1420-1427

Bertuzzi, Luca, and Luca Maini. “Benefit Design And Biosimilar Coverage In Medicare Part D: Evidence And Implications From Recent Reforms.” Health Affairs, 43, no. 5 (2024): 717-724

Media coverage: PharmaVoice

Feng, Kimberly, Massimiliano Russo, Luca Maini, Aaron S. Kesselheim, and Benjamin N. Rome. "Patient Out-of-Pocket Costs for Biologic Drugs After Biosimilar Competition." In JAMA Health Forum, vol. 5, no. 3, pp. e235429-e235429. American Medical Association, 2024.

Maini, Luca, Jacob P. Klimek, David C. Johnson, George M. Holmes, and Darren A. DeWalt. “Impact of Including Drug Spending in Oncology Alternative Payment Models” The American Journal of Managed Care 29, no.11 (2023): 579–584.

Hwang, Thomas J., Josh Feng, Luca Maini, and Aaron S. Kesselheim. “Medicaid Expenditures and Estimated Rebates on Line Extension Drugs, 2010–2018” Journal of General Internal Medicine 37, no. 14 (2022): 3769-3771.

Hwang, Thomas J., Stacie B. Dusetzina, Josh Feng, Luca Maini, and Aaron S. Kesselheim. “Price Increases of Protected-Class Drugs in Medicare Part D, Relative to Inflation, 2012-2017” Journal of the American Medical Association, 322, no. 3 (2019): 267–269.

Media coverage: FierceHealthcare

Other Writing

Maini, Luca. “Pharmaceuticals,” in the Elgar Encyclopedia on the Economics of Competition, Regulation and Antitrust, Michael D. Noel (Editor). Cheltenham, UK: Edward Elgar Publishing (2024).

Maini, Luca. “La regolamentazione dei prezzi dei farmaci: lezioni da recenti avanzamenti empirici, “ in Il Prezzo dei Farmaci, Fabio Pammolli (Editore). Bologna, IT. Società editrice il Mulino (2024)

Feng, Josh, and Luca Maini.“Where is the Good Stuff? Drug Quality Measures and Economic Research” NBER-IFS White Paper, 2016.